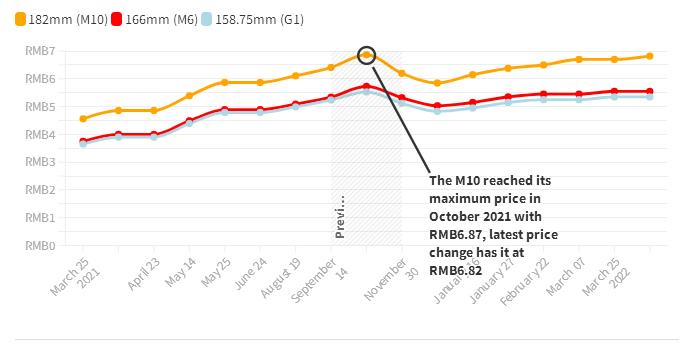

The cost of solar panel raw material polysilicon topped $40/kg this week, according to the China Nonferrous Metals Association, continuing a three-month upward trend.

The silicon branch of the China Nonferrous Metals Association (CNMA) this week reported the price of polysilicon reached CNY 255/kg ($40.04, based on yesterday’s exchange rate), thus continuing the upward trend that started 13 weeks ago. The latest price had risen 0.32% from last week. The association also revealed polysilicon production output in China this month is expected to be between 54,000 and 55,000 metric tons, with poly imports anticipated to amount to 6,000-7,000 tons. The CNMA estimated wafer production this month will be around 24 GW and said supply and demand will remain tightly balanced.

NYSE-listed polysilicon company Daqo New Energy on Wednesday acknowledged it risks being de-listed from the US exchange in early 2024 unless it opens up its books to US public body the Public Company Accounting Oversight Board (PCAOB). Daqo said it had been identified by financial regulator the US Securities and Exchange Commission (SEC) as having used an auditor whose working paper could not be fully inspected by the PCAOB, possibly after publishing its 2021 results to the SEC. Under the Holding Foreign Companies Accountable Act, in the US, listed businesses who breach that requirement for three consecutive years can be removed from a US exchange. Daqo, via the Cision press release platform, on Wednesday said: “The company has been actively exploring possible solutions to best protect the interest of its stakeholders.”

Reports in China suggest the transport of polysilicon from Xinjiang has been disrupted by local lockdowns, prompting wafering facilities to reduce utilisation rates and shutter in some instances.

It follows a surge in COVID-19 cases in China and the lockdown of major cities Shanghai and Ningbo, the location of two major ports which account for the significant majority of solar shipments. Road freight in the country is also said to be severely disrupted.

The Central Committee of the Chinese Communist Party and the State Council have issued a joint document calling for a unified national energy market. Construction of the system should be promoted by improving the oil and gas market, standardizing the construction of oil and gas trading centers, and accelerating the establishment of a unified natural gas pricing system. The authorities also want a national electricity trading center and improvement of a unified national coal trading market. Such public resource trading platforms will enable a unified, national carbon-emission market to be set up and will promote green product certification and labeling.

Part of the article excerpted from the network, infringement contact deleted.