Extreme volatility and high prices recorded on energy markets, coupled with inflation, and soaring interest rates are impacting long term power purchase agreements. Still there is a way to the success and signing of contracts.

This summer season has witnessed a series of unprecedented climatic events, including record-breaking temperatures reached amid consecutive heatwaves, wildfires, extreme drought, and water shortages. Hopefully this shall encourage wider collective ambition to hasten the development of renewables and limit the accelerating impacts of climate change.

PPAs (Power Purchase Agreements) are one way to support the development of renewables and limit the negative impacts of climate change. But what is the current status of the PPA market, set within the context of these extraordinary times? We propose taking a step back and reminding ourselves where we have come from, in order to realize where we stand, and most importantly, ask what comes next?

Firstly, let’s look back to where it all started with a focus on the development of energy and power markets. Back in September 2021, the markets were still rather tranquil, with energy prices moving up or down within a reasonable range: a comfortable configuration for PPAs, with a significant number of transactions being reported at competitive prices over the long term.

According to Bloomberg, 2021 recorded 31 GW of cumulative capacity of PPAs signed globally. However, by late 2021, a combination of factors led to an exceptional scenario for energy commodities in Europe.

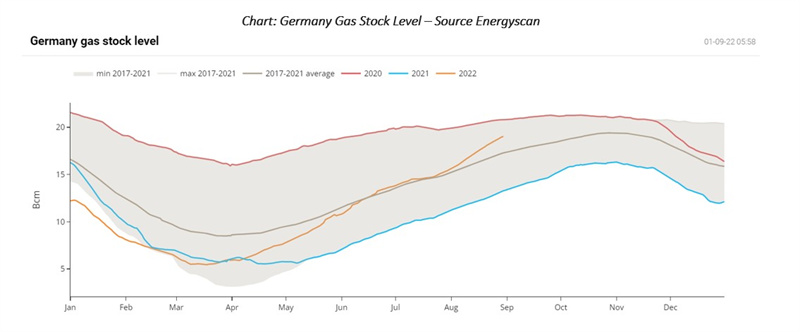

Phase 1: Between the end of Q3 and beginning of Q4 2021, cold temperatures landed in Europe, resulting in stronger demand for gas and power. Nothing surprising, except as the chart below demonstrates, for the fact that gas stocks in Europe were at the lower-end of the range, with the necessity to refill stocks, while entering the winter period. As demand for heating started to increase, this combination resulted in pushing European gas prices up, and quickly.

In the meantime, prices for European Emission Allowances (EUAs) which had been moving smoothly upwards over the course of 2021 on the back of more ambitious climate targets (such as the EU Fit for 55), also experienced a rapid increase from October 2021 onwards, trading just below 100 EUR/T by early-2022. Higher gas and CO2 prices accordingly pushed power prices up marginally, through still within “reasonable” and expected ranges.Part of the article excerpted from the network, infringement contact deleted.

Phase 2: In the middle of a winter (21-22) already hit by tight supply/demand conditions, Russia’s invasion of Ukraine propelled the whole energy complex to historically high prices on the back of fears of shortages and supply issues. The series of EU restrictive measures against Russia contributed to further tighten the supply/demand balance, such as the abandonment of the Nord Stream pipeline project (further reducing Europe’s gas sourcing capacity), or the consecutive bans on Russian imports, including alternative fuels such as coal, biomass, and oil.

Phase 3: More recently, extreme summer weather conditions, marked by severe droughts and consecutive heatwaves across Europe, poured more oil on the fire. Demand for air conditioning increased, while record-breaking temperatures also lowered water levels, emptying reservoirs, thus reducing hydropower capacity. Nuclear power production has been impacted as well, facing constraints to use river water to cool plants.

France, the most pro-nuclear power country in Europe (with 56 reactors, representing approx. 70% of the country’s electricity generation) has been the most affected in that respect, while the country was already struggling with maintenance and unplanned work to repair corrosion of reactors.

In another unprecedented event, France switched from being a reliable net exporter of electricity to a net importer, further augmenting the pressure on its neighboring countries including the UK which traditionally relied on its steady outflows.

The combination of all these factors reinforced the upward pressure on energy prices.

Part of the article excerpted from the network, infringement contact deleted.